What is a budget?

Budgeting is the process of creating a spending plan to know where your money is going and whether you will have enough money for the things you need.

A budget includes everything from daily necessities like housing and food to unexpected expenses. Budgeting also helps you forecast and save for future spending goals. Lastly, budgeting can help you stay out of debt or work your way out of debt.

A good budget is measurable, actionable, and realistic. Including these three criteria in your planning will help you stick to your budget and increase your likelihood of success.

What makes a good budget?

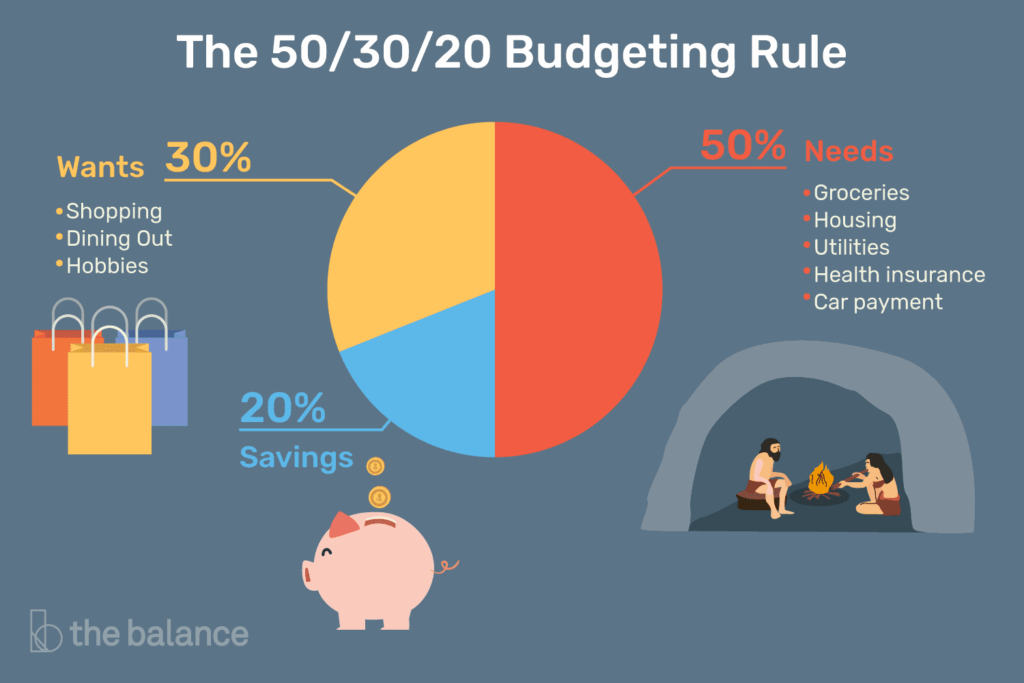

One common and simple approach to budgeting is the 50/20/30 strategy. This approach divides your expenses into three categories: Needs, Savings, and Wants.

This approach makes it simple and easy to make sure you are working towards your financial goals, without making you feel guilty for every cup of coffee you buy.

How do I get started?

Step 1: Track your spending for a full month to figure out where your money goes.

- Use your credit card and bank statements to get a full itemized list of all your daily transactions. Make sure to also keep track of any cash transactions.

- Look back over the past year and make sure to account for any one-time transactions (e.g. semi-annual insurance premiums) that should be planned for on a per-month basis. For example, if you know you’ll pay your semi-annual insurance premium in October, you can start saving for it earlier in the year.

- Categorize all of your expenses. Common items/categories to include in your budget include food, housing/rent, utilities, entertainment, and transportation.

- Tip: Lots of budgeting tools and apps are available to help with this. If you prefer, you can also keep track using a pen and paper or a spreadsheet file.

- Tip: To get a quick and dirty budget estimate, you can monitor your spending for a shorter period of time, such as one week, and then extrapolate these results to estimate monthly expenditures. While this may be quicker and less of a hassle, it will also be less accurate in accounting for monthly spending variations.

Step 2: Analyze your spending. What do you spend the most money on? Did anything in your spending patterns surprise you? Where do you think it would be easiest to cut back?

Compare your monthly expenses to your income and think about whether you are following the 50/20/30 rule of thumb. If you’re spending more than you’re earning or looking to save more, you may want to make some changes. Ask yourself some of the following questions:

- What are the things you want vs. the things you really need?

- Are there things you’re paying for but not using (e.g. monthly subscriptions)?

- Are there nice-to-have and/or not strictly necessary expenses where you can look for spending cuts?

- What trade-offs are you willing to make to adjust your spending to meet your financial goals?

Step 3: Set a budget and develop a plan to stick to it. Budget to fit your lifestyle, not to make yourself miserable. It’s great to set financial goals, but if your budget doesn’t fit your lifestyle, it will be very hard to stick to your plan.

- Think about and set some financial goals.

- Use past spending habits as a guide to predict your future expenses

— how long will it take to reach your goals? - Adjust your spending to reach your goals faster.

Step 4: Track your success! Check in every few months to see how your actual spending compares to what you budgeted. Make adjustments as needed.

Additional budgeting resources

From MIT Student Financial Services

Basic budgeting

50/20/30 strategy

THRIFTY (MIT CASE’s crowdsourced guide to money-saving tips)