What is credit?

Credit refers to your ability to borrow money to purchase goods and services. Financial institutions that grant credit, such as banks and credit card companies, use your past spending and payment history to determine your credit-worthiness as well as how much future credit to extend to you.

How is credit measured and tracked?

In the U.S., your credit-worthiness as a borrower is detailed in your credit report, which includes your personal information, your credit history, and a record of who has reviewed your report in the past two years.

The information in your credit report is also condensed into a single number—your credit score.

Your credit history is the most significant portion of your credit report. It shows your payment history with current and past creditors, along with your balances, dates of activity, payment amounts, and the types of debt you have.

How do I see my credit report?

In the U.S., there are three major credit reporting agencies—Experian, Equifax, and TransUnion—which create credit reports. The three credit reporting agencies may have slightly different information on you because, while most major creditors report activity to all three, many smaller creditors report to only one or two of them.

All consumers in the U.S. are entitled to access their credit report from each of the major agencies once a year for free. One free source of accessing your credit report is the website www.AnnualCreditReport.com.

Since credit is vital to lots of things in life, it’s important to keep track of your credit report to make sure it’s accurate and up to date. Experts recommend monitoring your credit report every year, before making any major purchases or life changes, or if you think your information has been compromised through a security breach.

If you find any errors in your credit report, you can dispute them and get them fixed.

What about my credit score?

The information in your credit report is often condensed into a single number—your credit score or FICO score. Your credit score is a single number that indicates the level of risk of default you represent to a creditor at a given moment in time.

The FICO score, the most common credit scoring model, ranges from a low score of 300, representing extremely high risk, to 850, representing extremely low risk. Generally, any credit score above 660 is considered a “prime,” or low-risk, score.

Because so much of the economy runs on credit, having a good credit history and FICO score is critical for getting approved for credit cards, mortgages, auto loans, cell phone service, or even getting your utility service turned on.

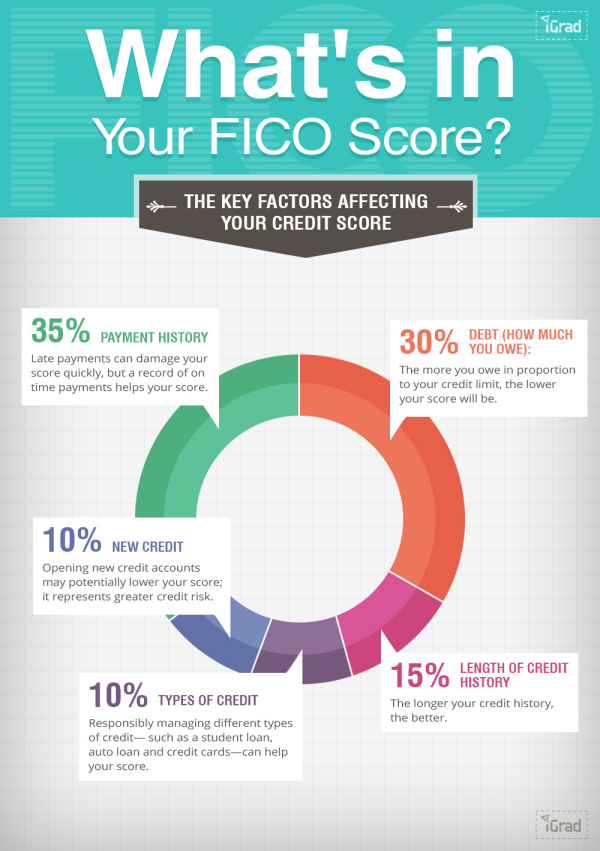

The FICO score consists of five components:

How do I see my credit score?

Credit reporting agencies are not compelled to provide you a credit score at no cost. However, credit scores are available for purchase through the credit reporting agencies.

Additionally, many credit card providers now provide borrowers with their credit score for free through their mobile/online banking platforms.

What if I have no credit or bad credit?

If you don’t have a credit history or have a poor credit history, check out these tips for building credit.

Additional credit resources

Best practices to building credit (MIT Student Financial Services)

The Points Guy: Beginner’s guide to credit

The Points Guy: Best first credit cards